2025-12-07

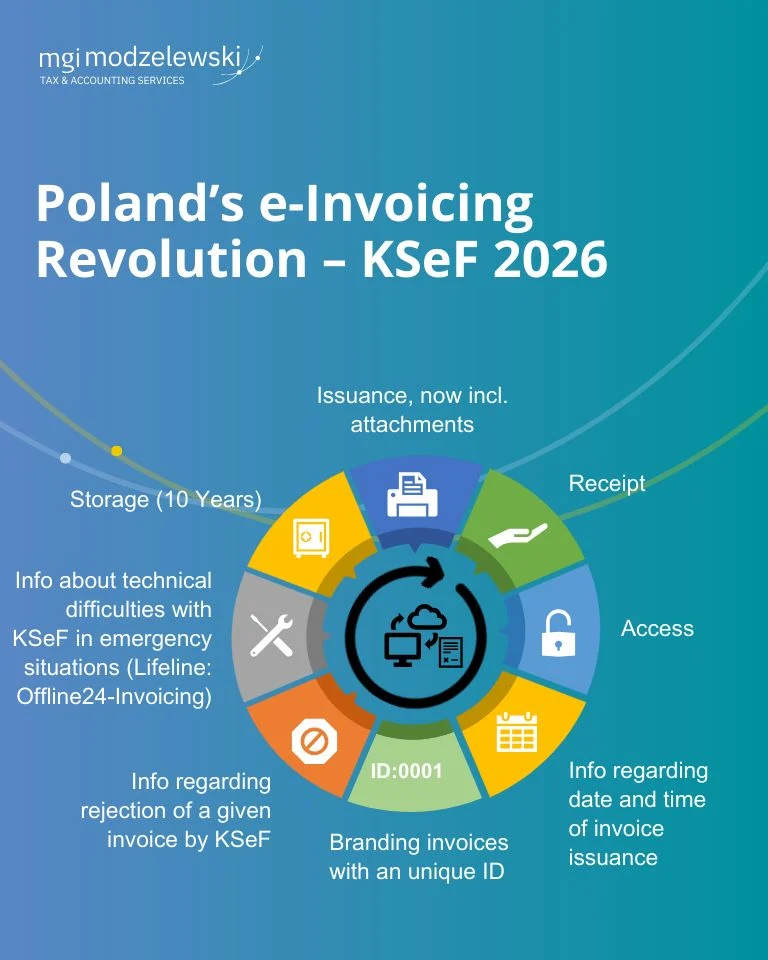

It may be worth seeking your own Polish tax ruling on invoices issued outside Poland’s e-Invoicing System (KSeF)

In 2026, plenty of “traditional” invoices (e.g., PDFs sent by email) will likely still be in circulation in Poland – some due to lack of awareness, some because of a misinterpretation of the rules, and some simply out of habit. For buyers, that’s not just an operational nuisance; it can also create Polish tax exposure.

In practice, a buyer may be left without clear answers to two basic questions:

• Why wasn’t the invoice submitted to Poland’s KSeF?

• Does it still allow the buyer to deduct Polish VAT and/or treat the expense as tax-deductible for Polish CIT/PIT purposes?

The uncertainty is compounded by the monthly PLN 10,000 gross threshold for invoices issued outside KSeF. A seller loses the right to invoice outside KSeF starting with the invoice that pushes them over the limit. From a buyer’s perspective, it may be impossible to tell whether the invoice they received should already have been issued via KSeF or whether it still falls within the “allowed” threshold. Cross-border transactions add another layer of complexity—especially when the key issue is whether a foreign counterparty has a “fixed establishment” in Poland. That assessment is often not straightforward, and it’s easy to get wrong.

On the VAT side, some comfort comes from individual rulings issued by the Head of Poland’s National Tax Information (DKIS) (e.g. case 0114-KDIP1-3.4012.838.2024.1.MPA and 0114-KDIP1-3.4012.507.2025.1.JG). These indicate that VAT deduction may still be possible where the invoice reflects a genuine transaction connected with taxable activity – even if, in theory, it should have gone through KSeF.

That said, tax authority practice can be inconsistent. So where significant amounts are involved, purchases are recurring, or counterparties are “hard cases”, it may be sensible to apply for your own individual ruling to secure protection tailored to your specific activity in Poland.

The biggest open question remains Polish tax-deductible costs (CIT/PIT) – there is still no clear guidance from either DKIS or the Ministry of Finance. All the more reason to consider an individual ruling in your specific case.