2025-04-29

Duplicate Invoices in JPK VAT

Everything is possible… yes, even a lost invoice.

In an age where invoices are primarily sent via email and technology occasionally plays tricks on us, it’s entirely possible for an invoice to never reach its recipient – not even the “SPAM” folder. For those who prefer traditional paper invoices, there’s always the risk of the document getting lost in transit.

Regardless of the circumstances, in the event of a lost (or destroyed) invoice, taxpayers may be required to reissue the document – sometimes weeks or even months later. While some sellers simply resend the same invoice (the “original”), others adhere strictly to Polish VAT regulations, under which a reissued invoice must state the date of reissuance and bear a clear “duplicate” label.

To understand why this matters, we need to briefly review the basic rules of input VAT deduction under Polish law:

Input VAT may be deducted only after the seller’s tax liability arises (i.e. the output VAT becomes due); and

The buyer may deduct input VAT only after receiving the invoice. Assuming the output VAT liability arose in the month of invoice receipt (or earlier), the buyer is entitled to deduct input VAT in the month of receipt or in one of the three subsequent months.

These same rules apply to duplicate invoices – but with an important distinction:

• If the original invoice was received but later lost

In this case, the duplicate merely confirms the original. The deduction window (month of receipt + 3 following months) begins with the month in which the original invoice was received.

• If the original invoice was never received

Here, the duplicate takes the place of the original. The right to deduct input VAT begins anew, effectively giving the buyer a fresh four-month window (month of receipt + 3 following months).

This distinction can have practical consequences when managing VAT settlements or preparing Polish electronic VAT returns (JPK_VAT) – particularly during audits or when filing corrections.

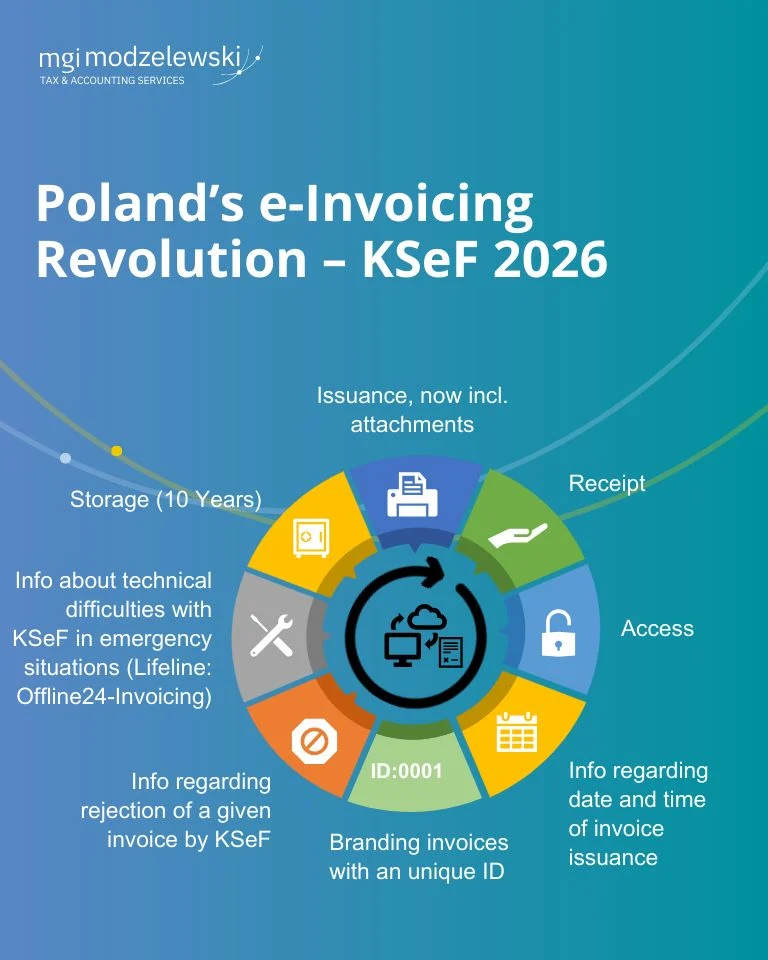

The above-mentioned issues should be eliminated once the official e-invoicing system is implemented (invoices issued and received via official data platforms). Although the ViDA initiative (VAT In the Digital Age) requires all EU member states to enforce such a system by 2030 for intra-community transactions and by 2035 for domestic ones, Poland plans to launch it earlier – starting in February/April 2026.

In the meantime, being aware of these nuances can help avoid unnecessary adjustments and ensure full compliance with tax obligations.