2025-09-15

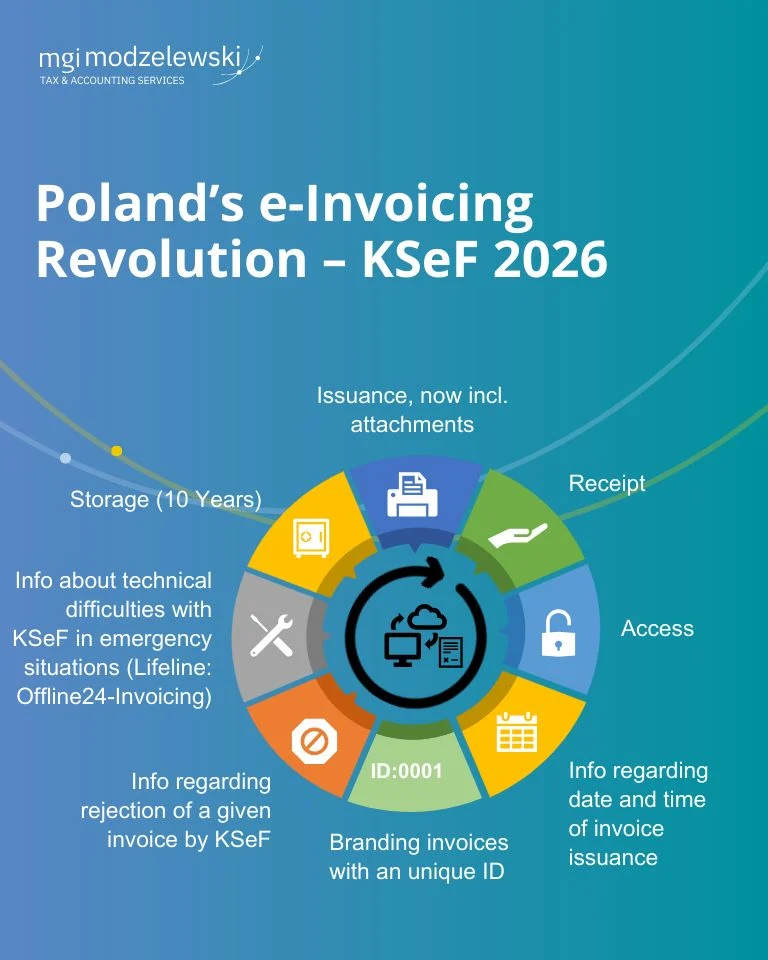

Poland’s e-Invoicing Revolution – KSeF 2026

KSeF 2.0 is here – the President of Poland has signed the bill!

On August 27, 2025, the President approved amendments to the VAT Act introducing the new version of the National e-Invoicing System (KSeF).

This marks one of the most significant tax reforms in recent years – transforming how every Polish company or entrepreneur issues and processes invoices.

KSeF rollout schedule

• February 1, 2026 – mandatory for entities with 2025 sales above PLN 200M (incl. VAT)

• April 1, 2026 – mandatory for other businesses

• January 1, 2027 – exception for micro-enterprises (monthly invoiced sales ≤ PLN 10K)

What’s new in KSeF 2.0

• “offline24” mode – a business may issue invoices outside the system, as long as they are uploaded to KSeF till the end of the next business day.

• Invoice attachments – the option to attach documents directly to invoices (hint: requires prior request).

• KSeF certificates – available from November 1, 2025, essential for authentication and offline mode.

• VAT corrections – the timing of submission to KSeF will at most times determine when VAT adjustments are to be made.

Who is exempt?

Foreign businesses registered for Polish VAT without a “fixed establishment” in Poland are not required to use KSeF.

Still, they may opt in voluntarily – for example, if requested by key Polish clients.

What does this mean for Polish business?

• Invoicing will become fully digital and centrally recorded, similar to Italy (as from 2020)

• KSeF 2.0 is more than just another compliance requirement – it’s a fundamental shift in how invoicing works across Poland.